File: 1612830000441.jpg (143.65 KB, 657x657, WuvLSt6v.jpg)

No. 734150

Sup nonnies.

I currently make 83k as a salary straight out of college aa an IT major. I'm planning on going to med school and I'm genuinely scared but excited. It may seem retarded but I'm just trying to follow my dreams.

I know eventually my pay will be at minimum 250k but the idea of not making any income for 4 years of med school is absolutely terrifying.

Should I go into stocks, start doing lottery or should I just try and save as much money I can while taking night classes?

>>734138How much is 1 bitcoin? Also how could I possibly cash it out?

No. 734188

I love this! I am in a great financial situation due to my upbringing (we "lived within our means") living frugally, and falling into some great financial opportunities. I hate work and I'm trying to retire before I'm 40 so I'm very motivated to save.

My advice to anons, think about the long term. Don't invest in single stocks and look into low fee index funds. Individual stocks are extremely risky and akin to gambling. Yes, you can win big, but you can also lose it all in a day - look at Gamestop. Index funds are slow and steady. You WILL make money, it may just take a bit longer.

Don't leave a lump sum of cash in a bank account unless you are looking to make a huge purchase (house, have a baby, expensive surgery) in the next 2-3 years. Look to put it somewhere where your money can work for you. Compounding is an amazing thing. Again, think of the long term. It'll be really slow going for a few years, but pretty soon your $1,000 will have turned into $1,500, then $2,000 even quicker.

If you do invest, try to avoid companies or funds that charge high fees - to me that's anything over .3%. The higher the fee, the less money that will be in your pocket.

>>734150Save as much money as you can and avoid single stocks. I recommend Vanguard. You can invest in a fund that tracks the total stock market (US or International) and forget about it. That way, you'll be having your money work for you, avoid lifestyle creep, and you'll be better able to pay off your debt faster, which saves you money on potential future interest payments.

No. 734199

>>734150BTC is being pumped by a 1.5 billion input by Tesla, and it's rumored that Apple is getting 6 billion soon, so the current price won't be accurate for very much longer.

One BTC is sitting at 46k.

To cash out, you can withdraw from your wallet to your bank, PayPal, etc.

Do your tax research of course.

No. 734220

File: 1612835946323.gif (400.67 KB, 400x300, 1578305774458.gif)

Honestly quarantine saved me a whole lot of money. I cooked at home more, I didn't go on my annual 'treat yo self' trip to NYC, and it gave me the time to settle into a minimalist mindset.

I was laid off for a month last year, then got a new job at a fantastic museum (visitor's desk) that paid more for less work. No more working myself to the bone. I used some of the unemployment money to move into a cheaper but vastly superior home (-$600→-$500/month). I used prolific (+$40/mo) for my bullshit buys, but I became a low-waste nut so the funds are mostly just sitting there. Joined my local Buy Nothing group too.

Last August, I decided to put on my big girl pants and finally learn about investments, so I played around in Robinhood (lol rip) and my chump change gained 80%. In a few weeks I'll be setting up retirement and index funds. I still have student loans (~33k– just repaying 9k private at the moment), and cc debt (~2k, transferred balance) but I have savings for the first time in my life. I'm planning to dump my tax return and Biden bucks into my private loan.

When travel restrictions are lifted and it's safe again, I'm going to take my first international trip ever!

No. 734224

If any of the anons who have economics degrees and know a lot about finances are here, I'd appreciate if you guys dropped some knowledge on our noggins

Just linking a couple posts from when the gamestop stuff was going on that had some tiny bit of info about investing

>>>/ot/725121>>>/ot/724895 No. 734275

Anons, I feel really stupid about needing such basic advice but I’m too embarrassed to ask my irl friends for help.

For most of my teenage/adult life I had been completely self sufficient, I never completed college but had a lot of good work experience and people skills. Managed to keep it up even while being depressed the entire time. Met my husband during this time, moved countries, got married, and was made to prioritize my mental health for the first time ever. Now that I’m functionally a normie, I’m desperate to contribute financially to the relationship again but I’m stuck for a number of reasons.

For starters, my grasp of my new country’s language is low-conversational at best. Then there’s the problem of me not having a solid degree, which usually covers for the previous issue in a lot of cases. I’ve already taken steps to enroll in an online university to finish my degree and to plan out projects for a portfolio, but now my issue is time.

It’s going to be years before I can see this plan paying off, and while my husband makes enough to provide for our family, I feel like an absolute leech. I want something to do in the meantime, even if it’s shitty, just as long as it pays. Do anons have any suggestions? I’ve been applying to remote work for companies in my home country, but every time I seem to be getting some interest, they learn that I’m in a weird time zone and drop me despite my willingness to work any hours required on their schedule.

No. 734315

File: 1612848288918.jpg (179.87 KB, 720x719, 1592100543702.jpg)

I'm becoming a trophy wife

I have insulin and heart and kidney medication and shit to pay for and I had to quit working because now I'm getting weird hormonal growths on my glands and shit, I'm done with the real world.

I've got the HVM, he's one of those sweet chuuni whiteknights, like the guys they put in movies with an uwu tragically sick but somehow always happy and quirky sick girl

So he's gets to have a The Wind Rises fantasy romance, and all he has to do is pay for all my medicine and shit, and I'm gonna exercise and do skincare, and that's gonna be just fine

And if he leaves me when I get to sick to be hot anymore, I'll take half his shit and come back and kill him anyway

No. 734324

>>734188>If you do invest, try to avoid companies or funds that charge high fees - to me that's anything over .3%. The higher the fee, the less money that will be in your pocket. I know this is written from a burger perspective but in a lot of countries, especially the more nanny state ones, this is all you have. We don't have Robinhood or similar brokers here, every trade incurs a steep fee if you're buying or selling any stock, fund, ETF, currency etc that isn't domestic, which is everything because it's a tiny country. You can also either trade through your bank, or designated brokers. The bank has limited options but lower fees if you have an account there, and the brokers have plenty of options and give you more agency but drum up fees like crazy.

On that note, I'm frustrated about the lack of investment advice for my country. EU-specific advice isn't entirely applicable to me because we're not Germany with a big stock market and varied options (and most advice for EUfags is mostly asked and given by Germans, French etc), but US-centric investment advice is completely useless to me.

We don't have big healthcare costs, uni is free, most people have state-guaranteed pension funds, but compared to the US salaries are low, taxes are high and owning a house is a pie in the sky pipe dream for most zoomers and millenials. Rich people have offshore accounts they launder money into instead, everyone else is just kind of stuck where they are. I make 3200€/month before tax, which turns into some 2200€ after tax, and most of that goes on rent, bills and various repairs around the house. I can't believe I effectively make almost the same money I used to make back when I used to work as a pizza delivery girl.

No. 734401

>>734324>We don't have big healthcare costs, uni is free, most people have state-guaranteed pension funds, but compared to the US salaries are low, taxes are high and owning a house is a pie in the sky pipe dream for most zoomers and millenials.French here, just reading this hurts because that's the truth. I have a masters' degree and because of my extremely bad luck and the pandemic happening very soon after I graduated I only managed to get a call center job and I'm paid only a little bit above minimum wage (so more or less between 1200€ and 1300€ after taxes), which means I'm not even sure I can get my own place until I get more bonuses, let alone buy anything in the near or far future. I'm saving money right now since I live with my parents but they're crazy as fuck so I have no freedom and private life whatsoever.

I'm seriously considering going full weaboo and saving money so I can become a useless English teacher in Japan later. Living there for some time was great and even in Tokyo I thought the cost of living wasn't as high as in my city, which is a big city but isn't anywhere close to Paris, and there are way too many things there that are insanely convenient that don't exist in France. I feel like I would have nothing to lose if I did this. I was considering going to other European countries before that, but I had several job interviews that resulted in managers not hiring me because of the borders closing a few days after said interviews.

No. 734427

>>734407Where I lived in Tokyo wasn't very expensive, I think I was very lucky in finding a cheap sharehouse that was located very close to a train station and stores. I live in Lyon, and while I know some cities are less expensive I was already way too poor to go anywhere when I became a student, even with my scholarship because my parents couldn't help me. They promised they would lend me money to at least spend a year abroad for an exchange program but it turns out they lied through their teeth. I though spending a year abroad as a student would give me way more opportunities and a bunch of friends from uni confirmed it helped them a lot.

I heard a lot of people saying they found work in Canada irl, mostly friend from uni, but they were trust fund kids whose parents helped them move there until they could save enough money to pay them back and pay for everything themselves later. Or they already knew people there, like family or close friends. I've been told that the biggest cities have horrible rent prices so I'm not sure moving there would change my situation but I'll look into it anyway for when (if?) the pandemic is over.

>Why must France be so shitty for finding work ?Even just getting a severely underpaid internship or apprenticeship is a miracle these days. I had to redo my last year of university just to get an internship because people wanted to hire me for free only and I needed a 6 month long internship, which means the employers would have to pay me. Once my internship was over I wasn't hired, I was replaced with another intern. And the only reason why they kept her is because they renewed her contract as an intern for 6 more months, they kicked her out as soon as she got her degree because that would mean paying her properly and giving her benefits. And that was a prestigious international company that makes A LOT of money. Another team in the company wanted to hire me months later and the CEO told them no because they reduced their budget just because fuck me I guess.

>>734423>Japan is overrated now.It seems like that's the case nowadays but there's still some demand at least for English. I don't know about teaching French in Asia in general though, besides my part time job as a French teacher in Tokyo, which I only got because the companies that wanted to hire me had to close down soon after interviewing me because of the pandemic. I'm thinking about Japan but default anyway, since I already know the language enough for my daily life and a little for teaching.

No. 735242

File: 1612937177467.gif (25.02 KB, 128x128, 1611727449644.gif)

Not financial advice etc etc but I would absolutely recommend buying Coinbase shares when they go public later in the year (I think I saw March somewhere, but there's no set date yet). Originally they wanted to start <$100 per share, then $100, and now the starting price is looking to be $200 which is quite steep. Very intimidating for those who have little to no market experience. But it's gonna be fucking huge. Being the first crypto exchange platform that is publicly shared, it'll go nowhere but up. I'm planning on putting a grand down on day 1.

Coinbase itself is a wonderful app, I highly recommend it if you're looking to purchase crypto. Binance is another great option but it's mainly for the EU and other non-US countries. Just be careful if you see coins like $doge where they're valued at like $0.0001, a lot of them are scams where the person/group running it will steal the money you invested in it. Big, respectable coins like BTC/ETH/LTC/XMR don't suffer the same issue and are safe to invest in.

One last major thing: your profits are taxed and you lose around 30% of your earnings. However, if you sell at a loss before the end of the year, you can write it off. It's worth looking into and makes losses hurt a little less.

We're gonna make it girls.

No. 735248

P.S. Please don't use Robinhood for buying shares. The app is poorly designed, and this guy killed himself over what he thought was a ~$730k loss but was actually massive profits because they displayed some information in a misleading manner. Can't remember the details but here's the article.

https://www.forbes.com/sites/sergeiklebnikov/2020/06/17/20-year-old-robinhood-customer-dies-by-suicide-after-seeing-a-730000-negative-balance/They also sell your shares without consulting you, even if it's at a loss. Scary shit. Use SoFi for your stock needs. You get $25 worth of free BTC when you buy $10 of it. My initial $35 is worth $52 now from doing literally nothing.

No. 735289

>>734149If you live in the USA: I highly recommend going to your financial department or asking the receptionist when you go in for any medical service for a financial assistance form, from now on. If you are unfamiliar with the process you are able to identify where you lie on their "forgiveness chart" based on your household income. Apply with your information to file a claim. If you lie on a certain bracket, your bill might be reduced significantly to basically nothing depending on your status. It has helped me when I worked at the hospital but did not qualify for the workplace insurance due to their contract. Hell, anyone can take advantage of this. I am not sure if there's a timeline from when you got the procedure/service/appointment done to receive the assistance but it doesn't hurt to ask.

As for your loans, just take advantage of their "loan forgiveness" programs now. I haven't paid in months because, well, my loan company didn't expect anyone to. However, don't expect it to last for long. Sorry, I wish I could help you more but please look into the financial assistance at least.

No. 735490

>>734315This is literally my situation. I ended up with a really nice and caring boyfriend who funds the whole dream while I focus on glitter glue crafts and making cat clothing. He seems to have a liking for helplessness, and I don't mind playing the part.

I just started a retirement fund and tax-free savings account for us instead of just keeping cash in a pile, and it made me feel like Mr Monopoly.

No. 735605

>>735449Thank you for listing some good stocks anon. I don't mind waiting at all, in fact I'd prefer that if it really is low risk.

Are there any anons that are into bonds? I've always heard that they're low risk too, but maybe they're more complicated.

>>735473How so anon? Because of the fees, or because you can't collect until after some (or a lot of) years? Would you recommend gambling with high risk then?

No. 735848

>>735605Degiro has low fees, but they don't store your money, they reinvest it which cannot guarantee that nothing will happen to it or indeed Degiro itself.

Options, futures and other derivatives are riskier and harder to understand than conventional securities, which is weird to suggest for someone who is new to investing. In general, you shouldn't invest in something you know absolutely nothing about.

No. 742288

Should I move back in with my parents after my lease ends this August? For background, I make pretty good money for a single person in a relatively HCOL city as I work in tech. More specifically, I am paid roughly 2x the amount of the median and mean salary in my city. I'm pretty good at budgeting and minding my money. The biggest monthly expense is actually my student loan where I allocate ~50% of my gross monthly pay, with my next expense is my rent, which is where ~25% of my income goes. I usually have enough left at the end of the month such that I can add that to a savings or pay off a bit extra on my student loans. I should be able to finish paying off ALL my student loans around August (ceteris paribus…) which is when my lease ends. I can either sign a new contract or go month-by-month. Considering the pandemic is and will still be ongoing (at least I don't see it getting much better, even with the vaccines), my work will still be wfh and I don't need to be in downtown which is where I'm living. Another thing is that my parents are doing just ok, not great, not bad, and I could help them out with expenses and things around the house while I save a ton of money. I like my parents fine and we rarely have issues. I'm not dating or going out like I used to because of COVID so those kind of things aren't really an issue. They give me a lot more space than I expected from my (Asian) parents, which is pretty nice. Should I do it? What are some things that I'm overlooking? I figure I can always move back out if it gets unbearable. Thanks anons!

No. 742297

>>742288Living with your parents is almost always the best choice for your finances, the deciding factor should just be how much you think you'd enjoy it or not.

I love being around my family and I know I sure af won't regret spending lots of time with them, so it's an easy choice for me to stay home and save up.

No. 754351

>>754346Because that's the average price of a house here and I'm not willing to move to a cheaper state. Plus he's doing good in his current position and would rather not drive an hour+ for a cheaper home. I'm currently in school rn but it's an AA and he dropped out of school.

I said I'd like to get a close as i

I can to 20%. Beat the PMI and pay less in monthly. Also regardless we don't have the money rn and hence long term saving tips. We just started talking about getting a home together.

No. 754381

>>754344First look at your expendable income. What do you both take home after utilities, insurance, rent, gas, and groceries? There's really not much you can cut out here except for maybe going to a food pantry once or twice a month or live with another adult. With all that expendable income calculated, can you scrounge up $130k within the span of 84 months?

There's also some more things to factor in such as emergency car repairs and the possibility of having to buy another car if something more serious were to happen to your current car. Good advice is to get a car under $3k and pay it off in full if you don't want to deal with interest rates. If you can take public transportation, ignore those last two sentences.

Also another thing, if you rarely visit the doctor's office or dentist or eye doctor, don't get insured, unless your job provides free healthcare. You're probably going to pay so much more in premium than a regular checkup, which is about $100-$200 out of pocket. At the end of the year during taxes you might get fined a few hundred, depends on the state, they used to fine everyone, but they got rid of that in 2020 and that is nothing compared to a total of $3.500 just for insurance premium. If you are not a burger, ignore these last sentences lol.

Honestly anon, I think some things will change within the next 7 years, but good luck.

No. 754422

>>754344First and foremost do not share finances. You're still so young and you do not want to risk your partner spending all of your money.

How long term is your long term goal? 7 years or retirement? If you weren't thinking about retirement, think about it now. Are you eligible to contribute to a 401k at work? If so do that.

If you're open to some risk and your time horizon is 7 years, look into getting a Vanguard account and you are employed, open a Roth IRA and invest in an index fund like VTSAX or VOO. You will be able to contribute your after tax money and be able to withdraw your contributions tax free after 5 years..if you are saving for a home, you can withdraw your contributions you made at any time. You will not be able to withdraw any growth until you're 59.5, but you'll need money in retirement too. You can contribute up to $6,000 per year - make that your priority.

If you can save additional after that $6,000 match, do it. Try to keep your money in your Roth IRA for as long as you can. Because it's tax free, you want it to grow and compound as long as possible, because all of that money is yours. With brokerage and 401ks, you will have to pay taxes when you take out the money.

No. 754549

>>754375Where I live the low it's 500k and median is 650k. I do happen to live in an experience area. The idea for a mobile home was to rent it out or sell it after giving it a refresh since they are cheaper. The idea would be that the rent for the land is less than 1100 and with the monthly being low, we could get easily 1500 for a 2/3 bedroom. It's not a lot of money but something to add up over time. And if we were to do a package deal, land & mobile, we'd put it on a permanent foundation.

>>754381Both have paid off cars and he has insurance from his company and I have cheap low income state insurance

>>754422We don't have any share accounts. We hadn't discussed about opening one together. He putting money into his 401k and currently does not have a roth ira since he's not even meeting the contribution match. Prior to me losing my job I was also contributing into my 401k. The 7 years is just for a home. Obviously things can change in 7 years but even if we split we both would be better off money wise since we both spent time saving up money. I did the basic math and going completely half each month we need to save about 750 each. Which hopefully we continues to go up the ladder in his company and after i finish school, I'd land a job in that field, should be slowly possible. If not that's fine. The goal to get as close as we can. Also we both still have our emergency funds, that should last it's a good a few months, maybe 6+

No. 781486

Anybody here a carfag?

I am debating whether or not I should go the electric car route, like if it's actually worth it. I'm looking at a couple used Nissan Leafs and the 45k-70k mileages aren't too bad. All within my price range of under $6,000. The thing I'm wondering most about is if it's just worth it? Would it be more reliable than other cars?

Like, compared to a hybrid, which I'm also looking at, Honda and Toyota hybrids. Our house already has one and it's been great with mileage.

I think my biggest concern is the battery of the electric car, like compared to if the battery in a hybrid dies out, it just simply won't turn off at a stoplight and it can still run, just worse mileage and you still have to replace it eventually. I also have to worry about the transmission or engine crapping out, which is still thousands of dollars to repair. Just the thing with the electric car, the battery dead, the entire car is dead until it gets fixed. I mean, no different than a non-hybrid vehicle, and even with the hybrid of the battery doesn't die, you still have to rely on the engine/trans.

Ugh, just cars in general stress me out.

No. 781915

>>781486I bought a Prius as my first car for about $3000 last year and I really don't think I'll be able to get anything else now. It may not be the fastest thing around but it drives so smooth, I love it. I can fill up my tank from 0 to full for like $15 and not have to worry about it for another 3-4 weeks. They have a great reputation for being reliable and I can definitely see it.

Definitely do your research before buying one though. The hybrid battery dies around the ~150-200k mile mark, but if it does before 150k miles I'm almost certain Toyota will replace it for free for you. If not, getting a new battery will set you back by around $2k. One of the most common issues with them is the coolant control valve breaking. If a check engine light comes on, it's most likely that. The dealership will try to charge $700+ for it, but the part is $80 and if you can find someone local to install it for you, it'll be closer to $300 instead.

No. 782109

>>756244Coinbase is just an exchange AFAIK. You don't need it to use cryptocurrency. You can just use a wallet like Electrum.

I'm going to throw it out there that most modern CPUs have management engines that have direct memory access. So doing anything with your private key on a modern PC isn't 100% secure. The best choices outside of hardware wallets for using cryptocurrency (not mining) are PCs with intel CPUs before 2006, or AMD CPUs before 2014.

>>735381If you're in Europe and you want to get into cryptocurrency, there's one called ğ1 that has adoption in France and Spain. It's meant to facilitate exchange, however.

https://www.gchange.fr/#/app/home No. 784969

Currently reading "I Will Teach You to be Rich" and I think it's an interesting read. I always like self help books because I think common sense isn't always so common and it helps to read to learn things that might be more obvious to others but not to myself. I'm about halfway through and I do like his approach- automation, a mediocre approach to saving/investing beats doing nothing at all, focusing on big wins and conscious spending than little one off things to save a buck here or there, etc. I just went over my budget and he says essentials/utilities should be allotted 50-60% of your income. Since I don't pay for rent or utilities (because my parents are very nice and don't ask for it) I've grouped it in with my saving. I have my bank automatically transfer 70% of every paycheck into my savings.

Even before reading the book I've been trying to move less towards buying lots of random knick knacks, just because I've been trying to move a little bit more towards being conscious about what I choose to buy and own (not full on minimalism, but no need to buy lots of random things to fill up space). I think I have to be more conscious and aware of what I choose to spend my money on, because even after saving a large chunk of my paycheck, I have a lot of disposable money in my checking account that I feel like I shouldn't spend all willy nilly because I don't want to become comfortable with spending a lot. I've maxed out my roth IRA for last year and this year, and have an M1 account where I've got a mix of investments. I might open a 401k with my employer, but I plan on leaving soon so I don't think I'd even get to take their match with me and don't want to deal with the IRA rollover if there won't be much in it anyway. Trying to figure out what other investments to put my money into, I'd love to hear what some anons have invested in/what platforms you use!

No. 953860

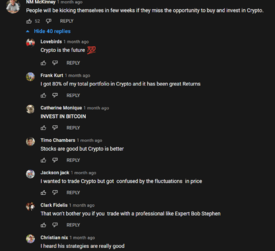

File: 1635536159911.png (86.44 KB, 951x867, 54165a5bd1379097f6302ae54a81e1…)

>>953851I'm just making a joke anon in reference to all the shitty crypto bots that have been flooding Reddit and Youtube comments.

No. 954236

>>954214All good points! I think target date funds are also really great too. I use M1 for my regular investing and they have a target date fund under their retirement pies that you can invest in regularly. I also like M1 because it's easy to visualize the diversification of your portfolio, and can rebalance at a click of a button (though it's unnecessary because if you auto deposits on, it'll dynamically rebalance your portfolio with the money you put in). The only downside for me is that you can't buy single stocks or anything, everything has to be in percentages. M1 isn't as super hands off as robo investors but I like being able to pick and choose my investments since I'm a bit more familiar with investing now, and I don't like that some robo investors I considered will keep some investments in cash only and there's no option to not have it do that.

Another point I'd like to add is that trying to beat the market is a fool's errand. Maybe you'll strike it lucky and beat it one year, but consistently year after year? Probably not going to happen.

>>954226>hand it off to someone who willWith discount brokerages now (places that will not charge a fee), there is no reason to ever pay someone to handle your money because even a small 1-2% fee will be exorbitant in the long run. I think it really pays off to even understand just the bare basics of things and figure out what to invest in. I mentioned it upthread, but I highly recommend 'I will teach you to be rich' to anyone who doesn't know what to do or where to start learning about investing. I think it's a rather practical book and despite the title, he doesn't really shill a magic potion of shorts, unless you count target date funds because the author

really likes those- but really, I think they are solid too if you have little knowledge of what to do and want to set it and forget it.

No. 954242

>>954214I YOLOd a bunch of money (20k) into random stocks I saw mentioned on 4chan at the start of the pandemic and then let it sit. One of them was WBT @<7 $ per share, 23 now. Another was MVIS, which I sold way too soon unfortunately but still made good money.

Guess I'm one of the lucky idiots

No. 954255

>>954242Damn, nice work.

>which I sold way too soon unfortunately but still made good money.That reminds me- when the people that I spoke to recounted the their biggest investment regrets, it was almost always about getting too emotionally attached to the success of a symbol/their strategy and getting screwed. That instinct will probably earn you more money in the long run.

>>954245Crypto is hot right now but it's a solution without a problem unless you use it to buy drugs, and investors are spreading hype pretty much entirely to increase their own earnings. If you're already making big returns then you'll probably be fine as long as you're willing to sell when the bubble bursts (or sell at a sharp decline and think about how much money you could have made).

No. 954950

>>954255I appreciate your response but am honestly surprised to hear your opinions on crypto given your background in professional finances.

To say crypto is a solution without a problem and only used for drug purchases is laughable, maybe that was true around 2017 but far from the reality today. Crypto is functioning as a sort of global currency, which is a great solution to the problem of international trading. Trading Bitcoin is way more efficient than converting USD to yuan, etc. It's also helping small third world economies like El Salvador that have previously relied on USD for their commerce, which has also left them vulnerable to USD inflation from the reckless US government. Sure, whale investors have a lot of power in cryptocurrencies and I could see validity in the argument that they hold more power over the value of cryptocurrency than your average Joe retail investor, but I still think it's a fundamental revolution that the average person has any say in the value or a currency. Up until this point only banks and governments have been allowed to determine currency value.

I'm curious about your thoughts on all of this as again, you have a professional background in finances and I've developed these insights without that. Ultimately I'd like to improve my understanding of these things so if you see holes in my logic please feel free to sound off

No. 956778

I've been watching this whole crypto thing for a while now (as an outsider, I want to be sure of how things work before really getting into it) but I still have some things I don't understand. Let's assume I invest $50 (a little amount, but not too bad for someone who only wants some passive income), does something catastrophic happens if the token's value drops, aside from, well, dropping? Even if it drops, we know that it's gonna go up again at some point because that's just how it goes with crypto, so why not remain calm and wait for it to gain value again? I've seen people (scrotes on reddit, mainly) absolutely losing it over a token's value going down a bit and just selling everything as fast as they can, so maybe there's something I'm missing? Sorry if this sounds stupid but I genuinely can't tell if there's some aspect that's slipping.

Where I live crypto is about to become big, so I'm considering getting into it a bit before that happens.

No. 957846

>>956778You’re absolutely right about what would happen if you held $50 in crypto. Crypto reddit scrotes are the absolute worst by their own admission, seriously don’t bother with that space. Investing money is a psychological minefield and most men truly aren’t cut out for it. A lot of those guys are focused only on finding the next small currency/chasing memecoins to invest hoping that it will someday be successful and make them millionaires, like what happened with DOGE coin.

The methodology you’re describing is the best way to earn passive income off crypto. Find 3-5 projects you trust and see value in, put what you’re willing to put in, and hold until it gains the value you’d like to see. Don’t get emotional about the daily/weekly turbulence of the coin and keep your eye on the prize knowing that crypto will inevitably be adopted worldwide. Bitcoin and Ethereum are the main players and are guaranteed to make you money (both are projected to explode this month and next, btw..) but there are many others that offer strong functionality and will make you decent money.

Hope this helps and you are able to make good money for yourself. Good luck!

No. 957891

>>956778That's called "bagholding". Some people hold bags for decades waiting for them to retain value.

Yes crypto will go up again, but so will Walmart and Amazon and other stocks on the market. If it goes back up to that level in three years, have you really gained anything?

No. 957898

>>956778they're either

1. are new to trading

2. invested more than they can afford to lose

3. using leverage (see 2)

No. 959069

>>958679Not a stupid question at all, basically just do research and familiarize yourself with the big players in the crypto space. There’s a YT channel called AltCoin Daily that I watch every day and has really helped me understand the space more, on top

of a few other crypto news pages.

Some basics: Bitcoin is the original and most popular, but doesn’t offer much utility beyond being a globally accepted storage of value. Ethereum is the second most popular and supports the NFT digital art marketplace, among other things. Other main players like Cardano and Solana attempt to do what Ethereum does but cheaper and faster. There are certain coins that support specific functions, an example would be MANA which has spiked in value since Facebook’s Metaverse announcement as MANA offers blockchain technology to support virtual reality platforms.

All it takes is a bit of research. You got this!

No. 959319

File: 1636035883212.jpg (12.62 KB, 400x400, CYslnxfM_400x400.jpg)

Are there any passive income websites (EU friendly) that you would recommend?

Not ready to invest in crypto yet. I heard of Honeygain but found out that it's not that good if you are from a small country (eg user from Finland still can't withdraw all of their earnings) and your IP gets blacklisted.

No. 959358

>>959096doing a dab for you

nonnie, hope you get your red car and trip to Paris before you an hero

No. 963761

>>956778Tip: stay away from reddit, twitter, and any other "crypto" spaces. These guys are faux day traders practically gambling in shitty projects and trying to shill you into buying them. Retard-proof way to get into crypto is invest in Bitcoin and/or Ethereum and don't sell for a few years. If you decide to buy different coins, do your research but keep your main holdings in BTC and ETH. Look at the highest market cap coins and research them. What is their use case, how are they different than other coins, who is the developing team behind the coin. Look up white papers. Watch interviews or talks with the developers. Start reading crypto news. A good place to start is coinmarketcap. If you can afford to, I would suggest "dollar cost averaging" (DCA) which is basically investing the same amount of money over a period of time, rather than trying to time the market. Good luck

nonny.

No. 1011431

File: 1640988253893.jpg (110.38 KB, 392x445, 43 - JakyghM.jpg)

Nonnies what should I do?

I only have a total of about 4200 to my name. I am currently 3700 dollars in debt. I wanted to go into the New Year debt free… but I also don't want to be flat out broke. I can either

> 1. Pay everything off today

> 2. Pay off one bill ($700) and then pay 1000 a month for my $3000 dollar bill.

The risk with option 1 is that I could possibly lose my job or there could be an emergency and then I'd have nothing at all. The risk with option 2 is just feeling fucking awful, going into the new year with debt until that debt is paid off for the next month or two.

No. 1011476

>>1011431What is your interest rate?

If you won't save any money on interest by paying early go with option 2. Then please promise me you will start saving up for an emergency fund.

As much as the feeling sucks, being in a little bit of debt is better than being completely fucked if you have an emergency.

No. 1050146

File: 1643828511598.png (173.86 KB, 2400x2404, google-g-2015-logo-png-transpa…)

Google is doing a stock split, who's buying?

No. 1246305

>>1245057Sorry for late reply, but I think Schwab is a good one. I have a checkings account with them (as well as my IRA and switched my regular investments to be with them too) and I like them. They aren't my main bank account so maybe my experience isn't too helpful but I think they are a decent bank. Like you said, no foreign transaction fees but also no account minimum/maintenance fees, offer ATM reimbursement, and their customer service is always really great whenever I have questions. This might also not really be relevant to you, but they also give you a free checkbook. No one really uses checks but there's always an occasion that pops up where I need to use one so instead of buying a sheet of 3 from my main bank for $2 (or paying out the ass for a whole checkbook), I just use the ones from Schwab. Replacements are free. Doesn't hurt to have a checkbook.

Only downsides I've encounter is 1) takes a while to be connected to customer service over the phone and 2) not really all that fond of their app layout. It's not awful and it's definitely usable and you can get all the info you need like account balances and transaction data, but it's just… maybe a little confusing to find where some info is (especially when I'm looking at my IRA account).

I've shilled the dude's book ("I will teach you to be rich") upthread and I recommend picking it up if you ever have the time/chance, but here's a list of recommended bank accounts from his website. You can google more "best checking accounts" lists to compare and contrast with his if you don't want just one dude's opinion.

https://www.iwillteachyoutoberich.com/blog/best-checking-account/I have a Discover card that I occasionally use and it has no foreign transaction fee. Downside is that it's Discover so it's not accepted everywhere. I've personally been looking to eventually get the Chase Sapphire but it has an annual fee. Here's another list with some cards.

https://www.bankrate.com/finance/credit-cards/no-foreign-transaction-fees/ Personally if it were me, I'd go with the Capital One Quicksilver because I hate BofA.

No. 1246854

>>1246754get the braces then

nonnie. when i was 20 $500 was a lot of money to me. now at 30 I wouldn't even notice $500 given or taken from my bank account. just get a job and make it back. the money is there for your benefit, not to decorate your bank. money is nothing but a tool to gain things you need.

No. 1247338

>>1247286Based. I had way, way too much money invested in a single stock. It took a downturn. My net worth dropped by 25-30%. ETF's and mutual funds are the best. Any kind of investing is a gamble, but passive investing is the safest and you'll still make money long term.

But remember long term is like 10+ years. Think of the long game and saving now means you won't have to stress about making money later in life when you're old and tired.

No. 1247911

Robinhood is giving me 1% interest on my deposits that aren't invested yet. The bank offers me 1/10 that. Then again inflation is 20% or some crazy shit so we're all eating it. Why is life so hard? Boomers got 10% interest on their savings account. Not even joking, you can look it up.

>>1247338Damn

nonnie even GME didn't do me like that. Confess, what was the stock?

No. 1248798

>>1246305how long did it take for you to get your checking account approved? I just applied and it gave me the brokerage account right away, but it's saying it needs more time to review for checking account.

I'd only be using schwab for the checking right now, although maybe I'd also use it for investing eventually. it also wouldn't be my main bank account.

No. 1280236

>>1280148the issue with investments is that the higher returns they offer, the riskier they are. With a high risk investment you may be able to get a lot more money quickly but you're also more likely to lose it all.

For retirement it's probably better to make a long-term investment with lower risks since you have a lot of time.

I'd listen to your parents, not your friend. You don't want to gamble with your retirement savings.

No. 1280319

>>1280148Your friend is half right and half wrong. You should be investing your money to grow it, but you should be investing it through your retirement plan. When you put your money into a retirement plan (be it an IRA or a 401k or whatever), you can invest that money within the retirement plan. You should be investing through your tax advantaged retirement account, not through a regular brokerage where you are subject to very high capital gains taxes. Yes you can leave it as cash in the retirement account, but that’s the same as leaving it in a regular savings account ie stupid idea because of regular inflation, your money

loses its value. Even if you invest in just something that tracks S&P500, your money will increase in value ~8% per year. Is it guaranteed? No, nothing investment in guaranteed, but look at the data and you’ll see the value has always increased since the start. You don’t want to pick stocks or do research? Cool. Most places you can open a retirement plan with have something called a “target date index fund.” The key is that it’s an index fund, ie not actively managed and therefore will not cost you thousands in fees (1% will fuck you up over the ~40 years your money will be sitting in there). Target date index funds do all the work for you and will essentially focus more on investing in stocks in the early years (high risk high reward), then as you approach retirement will shift to investing more in bonds (or something like that, its just low risk, low reward). You don’t do a single thing except putting your money into the account (AND making sure that money within the account is invested into the index fund). If you really give a shit, I think you can find out what specific stocks and bonds will be bought. For the love of god don’t leave it sitting there as cash.

Here’s a video that explains the difference between a regular IRA and roth IRA. The regular/roth can be applied to a 401k too.

Also I believe you are allowed to withdraw from your retirement account, up to the amount that you have deposited (so if your investments got u $200 more in the account, you can’t touch the extra $200 without penalties). It’s highly recommended that you don’t touch any of the money though, because any money taken out is money not in the market growing for you. I treat it as my last resort safety net. Also I know I probably sound like a retarded finance moid but please please please open a retirement account and invest some money into it. Even a few hundred dollars a year is better than nothing.

No. 1280456

>>1280447Hm, honestly I'm not too sure about 403bs! I just did a quick skim on google and they look to be pretty much about the same for the most part. There are slight differences, but I think at the end of the day they won't matter too much for you. I think your employer will most likely have you talk to the broker when you open it, and you can probably ask that person then too.

Also I forgot to mention the vesting period. Employers will typically offer a match for 401k and 403bs (they will put in a small amount of money, up to X% of your salary). The vesting period is how long you must stay with the company before that money your company puts in is truly yours. For example, my company's vesting period is 6 years. If I leave after one year, as stated in the employee handbook, I can only have 20% of what they put into my 401k (plus all the money I put in too of course). Regardless of the vesting period and the employer match, I would highly recommend putting in money as soon as you're able to anyway. I max out my IRA every year, so putting it in my 401k is a way for me to add more money into my retirement funds without getting hit with penalties for going over the limit. If you leave your company, you can "rollover" your 401k/403b into an IRA and no one will come after you for going over the limit (assuming you max out your ira).

Sorry if this is a lot of info! It's really daunting at first, it took me a while to really understand everything, but I hope I made it understandable enough! Once you get it, it's really simple.

No. 1303905

File: 1660587082837.jpg (144.89 KB, 800x533, Savings-bonds-1.jpg)

For all my fellow burgernons, the interest rate for i-bonds is 9.62%! You can buy up to 10k worth of i-bonds, and it's only for bonds issued up until Oct 2022.

No. 1323185

>>1322898First things first, keep some in a savings account for emergency money. People advise keeping about 3-6 months worth of expenses in savings but since you live with your parents that number might be really low/off. I'd say maybe 1-2k for each month would be a good amount, or just some random number like 10k or 15k or whatever feels most comfortable for you. Next I'd set up a retirement account if you don't already have one. See my above post about retirement

>>1280319. If you are working, set up a 401k through your job first (speak to HR about this, they should be able to explain everything to you and answer any questions). The yearly contribution limit to a 401k is 19k per year.

If you

still have some money left over, create an IRA. There's lots of places that offer one such as Schwab, Fidelity, etc. Look up "best ira accounts" or something and read the comparisons by other people. You can have both a roth and regular one, but note the yearly contribution limit is 6k total between both IRA accounts.

If you still

still have some money left over, you can then open up an online brokerage account and invest in silly stocks or what have you. At this point, this should be money you're comfortable losing so you can invest in bitcoin or stocks, or if you still want to be conservative and play it safe, you can still invest in index funds.

Focus on emergency savings and retirement accounts first. Like I said above, you can invest through your retirement accounts, and they are tax advantaged!! If you invest and buy via a regular brokerage, capital gains tax (i.e. tax you pay on the money you make when you sell your stocks or whatever) can be very high. You want to keep as much of your returns in your pocket. Also highly recommend the "I will teach you to be rich" book, because he breaks things down very simply, especially investing. You can skip around to the chapters that apply to you (he talks about paying off loans for a chapter or two), but I highly recommend reading it front to back if you ever get the chance. You can probably pirate the book or get the ebook from your local library via overdrive (or just make an account for a major library and borrow it).

>>1322900https://www.treasurydirect.gov/indiv/research/indepth/ibonds/res_ibonds_ibuy.htm No. 1365401

File: 1665016982651.png (156.34 KB, 240x275, borzoi.png)

Hi! I have a freelancing job and I realize that I should stop being dumb with my money. I want to invest some of it incrementally (like, 30$ a week) and in hopes of making a mild-moderate gain overtime.

Is Vanguard a good starter option for such purposes? And yeah I am willing to learn more about certain things on my own, just wondering what is really worth it, if I need to hardcore inform myself, or if it's better for a total newbie for me to find an extremely safe option and stick with it.

No. 1366654

>>1365401Vanguard is the best option and not just for beginners, it's a safe choice for the rest of your life no matter how much you eventually learn about investing. A good read: >

https://www.reddit.com/r/investing/comments/1owcra/comment/ccwd45j/You don't really need to do a tonne of research, it's good to know what you're doing and it can be quite interesting. But in a practical sense it's easy, the same ETFs are recommended to pretty much everyone and you'd be on the right track if you just consistently invest without selling in a panic if the market dips. I'm not sure what 'over time' means to you, it might not be ideal if you want to sell within a few years, but this sort of investing is meant to be long term and done with retirement in mind.

No. 1377834

>>1377831Gonna be honest, millions of people around the world are competing with you for those nice online only passive income gigs. But if you look locally, you have waaaaay less competition and many part time desk jobs can eventually allow you to work remotely most of the time.

Easy passive income is only really obtainable if you either already have money or some sort of media fame

No. 1377840

File: 1666048718092.jpg (59.37 KB, 600x564, 3129b9e7ca6ac1918666e4dcb70a8e…)

>>959096UPDATE:

My weed stocks have NOT exploded, in fact they have pretty much imploded. Not selling tho. Currently also trying to import 350lbs of walnuts for my next endeavor. If it all doesn't work out it's nbd I'm killing myself in 4 years anyway

No. 1377994

File: 1666061022698.jpg (76.38 KB, 640x853, tumblr_9c12bf1422d061903ecff67…)

I have finally started getting some consistency with savings/ paying off debt after years of being a bpd mess with money.

I started 37k in debt at 29 years old

owed 15k on my car

12k on a personal loan and 10k split between two credit cards

I work in STEM and earn good money but have never been able to get my shit together until recently.

Aggravating factors:

- broke my leg so couldn't work for 6 months (3x surgeries, lucky the medical care itself was only about 5k out of pocket)

- came from a shambolic family who are spendthrift

- used to drink and smoke cigarettes which cost hundreds each week

- totaled a car without insurance when I was 25- needed to buy a replacement and stupidly bought new on finance

- just all round acopic when it comes to spending- would online shop to deal with job stress/ compunding money stress etc

I have paid off 33k in 2 years and only 4k on a credit card remains which I am hoping to pay by December. The car is paid off.

What helped?

- quitting drinking and smoking (champix for smoking worked for me) and I quit drinking cold turkey 2 years ago

- track all money religiously in a scrapbook/ journal each day. I find it kind of soothing and by plotting it on a graph it eliminated a lot of the fuzzy maths I was doing to justify buying things

- the more I started saving/ paying off debt, the easier it became. Sounds cliche, but seeing progress spurred me on.

I'm not there yet, but the weight of hectic debt being off my shoulders has improved every aspect of my life. I hope my post helps a nona out there.

No. 1428403

>>1428138I am working two rn to pay a small debt off (family no interest) and keep my head above water on current bills. Yes it is working but I sleep as much as possible on my 1 maybe 2 days off. I'm either sleeping, eating, or cleaning my home rather than enjoy my hobbies. It is around 50 hours a week between the two sometimes less.

>>1428391 Fix up thrift store clothes and depending on your country do not use mercari which will close down your shop after a certain amount of sales until you put in the tax form info. There's an anon who imports sanrio stuff and insanely overprices it too.

No. 1539956

File: 1680518815834.jpg (22.87 KB, 620x413, sweatin.jpg)

Should I get a credit card before I go travelling? I'm going overseas for a month and have all of my accomodation and transport paid for but thanks to poor big-picture thinking and budgeting, day-to-day money might be a little bit tighter than I'd been planning. It's still doable but I would be hamstrung in terms of sightseeing and getting out there and seeing it all. A friend suggested I take a credit card with me, "live it up over there" (his words not mine), and pay it off when I get home. I'm smart enough to not live beyond my means on credit but having it in case of emergencies sounds pretty good. I haven't been able to find any financial advice strongly recommending one way or another. Should I? Would you? Additional info, I'm 23 with a degree in construction, working a junior-level role in my field.

No. 1880019

File: 1707268693565.jpg (31.66 KB, 395x296, thank u nonnies i wuv u <3.jpg)

>>1880005Thank you for bumping this I honestly never knew we had this thread but I'm about to read through the whole thing.

No. 1880528

>>1880306I used it for my house but just a note of caution; there are some fees if you take the money out for other purposes and there’s an upper threshold for house price (450k, mine was just under it at 400k but if you live in the south it may not be much use)

There are noises about trying to fix these issues and the amount i received covered the legal etc fees for buying my house even if i didn’t max the isa out but i’d take these factors into consideration before opening one

No. 1880546

File: 1707308664821.jpeg (49.15 KB, 736x409, IMG_2635.jpeg)

>>1880536On the tools i use; i use the uk budgeting spreadsheet and review my spending every month, i set aside my bills and savings at the start of the month and play with what i have left (about 300 every month), i let myself take a bit out if i need but never usually more than 100-300 a month, on average i save about 600-1k a month but i rlly don’t have a life haha

https://docs.google.com/spreadsheets/d/14LZtN7G068QLKAzZSK6gvxhL-4DVCgdqKQtrtiRDlZA/edit No. 1880783

>>1880536My short term goal is to cut back on my entertainment spending. I’ve done this by cutting out drinking except for special occasions (so I haven’t drank in a month), and next I’m going to cut out weed. I’ve also started turning down invitations to go out when it’s not something I’m dying to do, which saves me at least $30 a month.

My long term goal is to buy a house in the next 5 years. I have $15k in savings that I’d like to add $8k+ more to in the next few years. I don’t have a specific plan on how I’m going to do this, I’m hoping my brothers girlfriend will move in with us this summer so the rent would be split 3 ways and my share would decreased by $200— I could save over $2000 in one year that way.

No. 1880852

File: 1707333439519.jpeg (45.49 KB, 400x400, IMG_9228.jpeg)

>>1880528Useful caveats ty. I’m a Northernfag so will be well under the max threshold. Out of interest, did you buy with a partner or alone? I’m going it alone and it’s daunting but also will be nice I think when I finally get there to know I did it totally solo (I don’t have any inherited money or anything like that helping me out either).

The Moneybox app also has had me trying my hand at investing. I’ve kept my substantial pension funds where they are because - I won’t say what/where they are at the risk of outing myself - but they’re good and I’m lucky to have them. I gathered together pension pots from various other places like temping jobs when I was younger though and pooled them into the Fidelity Global Shares fund which has grown by 28% in the past 3 years which is cool.

I’ve just set up a Stocks and Shares ISA too which I use to invest in ESG funds only because I want to make money where I can but in the least ethically dubious way possible. I’ve only got a little in there at the moment because I’m just trying it out and prioritising savings over investing in the short term.

My family are pretty bad with money and went bankrupt when I was a kid so I have had to teach myself a lot and try to unlearn a lot of emotional stuff I carried with me around personal finances. ‘Manage Your Money Like a F*ckingGrown Up’ and picrel are decent books for starting out on that journey.

No. 1880930

>>1880852I bought with a parent; it was complicated but it was the panny, our landlady was selling because she was ill and my mother got super ill too. I wanted to move out but i had to secure out our housing because i have a lot of younger siblings so i used the money i’d saved up from my uni job and my little lisa as well as my mothers savings to sort everything out.

It wasn’t too unmanageable; I’d definitely say definitely get a mortgage broker but if it’s just you i imagine it won’t be too complicated. I had a lot of extra legal stuff to deal with so i could access my father’s savings etc but apart from that there wasn’t anything too complicated.

I am in my mid twenties now and despite my parents being able to save well; i’m realising they aren’t financially literate at all actually, e.g they just kept the money in normal savings accounts and maybe a S&S isa. That was all i was taught and not even in detail so i’m having to learn about investing and structuring savings from scratch. My family was always financially stable despite everything but i can already see their attitude is not going to work going forwards

I’ll have to check out the book recommendations; thank you

nonnie they look super helpful!

No. 2140011

File: 1723879075498.jpeg (621.86 KB, 750x938, IMG_5340.jpeg)

I was in a lot of consumer debt in my twenties (37k$- car, credit cards, overdraft) due to being a bpd bitch from a family with fucked up spending habits. Anyway I turned it around over years and all the debt is gone and I’ve hit savings targets. However I feel more stressed about money now than ever. It was almost comforting being in debt in some messed up way because now I’ve got something to lose and every day I worry about going backwards. No amount of savings makes me feel secure and not worried it’s just going to be taken away somehow. Sorry niche problem but can any other nonas relate?

No. 2225878

>>2225638Usually the former.

Physical is safer because you have full control over it, but paper gold(stocks, ETFs, etc) is more convenient. If you plan on holding for a long time, physical is better, plus it may be more tax efficient depending on where you live. You can get either coins or bars, the price of a bar is determined by its gold content, whereas a coin with the same amount of gold will cost more due to numismatic value. Apparently coins are easier to sell, especially the well-known ones.